Decals help you add flair to your virtual world in Roblox. It allows greater customization of stock objects. You can choose decals that fit the game’s theme or give the game a more personality for an enriching and fun experience. Unlike textures that repeat across the surface of the object, decal images stretch to cover the entire surface.

If you’ve been exploring the Roblox world and are looking for ways to use Decals, then you’ve come to the right place. In this article, you’ll learn how to create, add, and use decals in your Roblox Studio.

Adding Decals to Objects in Roblox Studio

You’ll first have to select the decal image ID you want to apply before considering how you can add and use it in the game. You can use two methods to achieve this, browsing the Creator Marketplace or letting the creative juices flow and build your own design. For players who want to avoid creating new decal designs, the Creator Marketplace provides a library of decal designs for use.

The steps below will guide you on how to use a decal from the Roblox decal library:

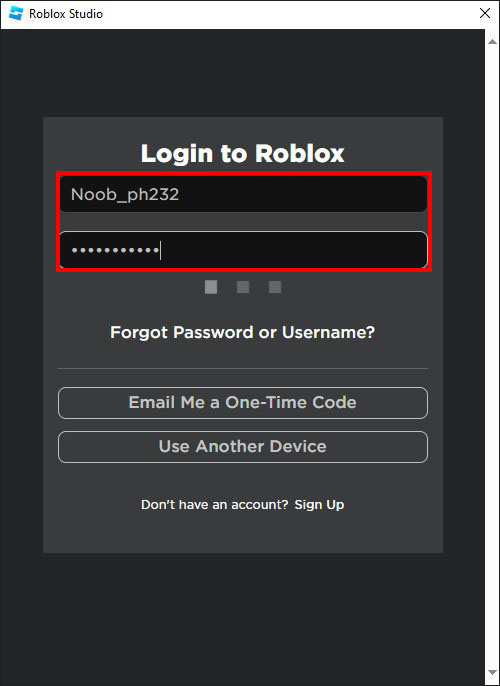

- Open the Roblox Studio and log in to your account.

- Navigate to the game you want to customize and click on it to select.

- Click on “Marketplace” under “Toolbox.”

- Select the “Images” option on the left pane under the basket icon.

- If you can’t access the toolbox on your screen, find “View” on the toolbar and select “Show.”

- Type in the decal you wish to apply on the search bar to locate the image. You can also filter the search using the creator to find the image quickly.

- Once you’ve located the image, right-click on it and choose “Copy Asset ID.”

With the ID in your clipboard memory, you can go to Roblox to apply it. Here’s how:

- Open your Game Editor Window.

- Use the “Game Explorer” to find the object you want to edit and select it.

- Click on the down-facing arrowhead to view all the decal parts.

- Move over the decal parts, and click on the “Plus” button and choose “Decal” from the drop-down menu.

- Paste your decal ID image on the Texture property under the decal “Properties Window” and hit “Enter.”

- Apply the decal to the surface you want it imposed on by shifting the decal face to cover all sides. (Left, Right, Top, Bottom, Back, or Front)

How to Upload Custom Decals to Roblox Studio

Roblox Studio Asset Manager allows you to upload customized images to your game. For this to work, the game needs to be published.

Roblox Creator Documentation has a comprehensive article to get you started on custom decals.

Here’s how you can upload your customized Roblox decals for your new game:

- Build your decal design inside your new game.

- Save the image to your PC.

- Navigate the Roblox home page and select “Create.”

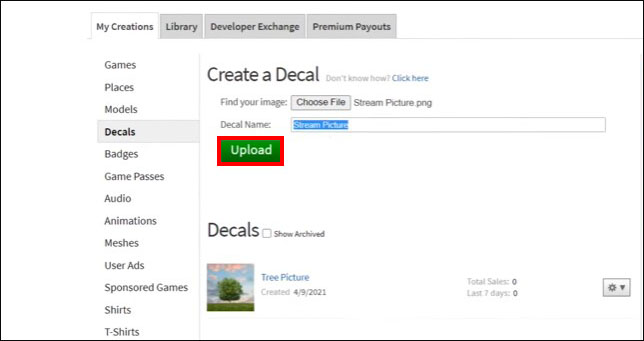

- Go to the Roblox Creator Dashboard.

- Find the “Creations” option on the left pane.

- Select the “Development Items” tab and go to “Decals.”

- Browse to find the decal image you want to use and select it.

- Designate a decal image name by typing it into the text box and click on the “Upload” option.

- Wait for feedback from the platform moderators.

- Once the image is approved, the notification “Decal successfully created” will pop-up on your screen.

Once the image is uploaded successfully, it will receive an item ID you can use to apply to objects as a texture or decal.

Selecting the Right Decal ID in Roblox

The process of finding the correct decal ID appears complex for many gamers. But it’s often easier than it seems. Following the steps below will guide you toward picking the valid Roblox decal ID:

- Launch the Roblox website and sign in to your account.

- Click the “Create” button located on your screen’s top bar.

- Choose “Decal’ located on the left pane of the “Create” window.

- Select the decal you want to use from the list displayed on your screen.

- Navigate through the decal catalog page and record the decal ID displayed on the URL. The ID appears in this format “https://www.roblox.com/library/{ID}.”

Easy Way to Add Decal ID In Game

Once you have the decal ID, you will need to find a way to add it to your Roblox game. The easiest way to do this is to use the Spray Paint device. You can purchase this at the shop for 350 Robux. Here’s how you can add the decal ID in-game:

- Launch your Roblox game.

- Click on the Spray Paint device.

- Use asset ID to apply.

Troubleshooting Decals in Roblox

There are a few challenges you may come across when trying to use decals in Roblox. The troubleshooting options listed below can help you fix issues you may have:

Blurry Decal Images

Decals can appear blurry if your connection to the server is poor. If you notice that your images are blurry, you can try resetting your network. You can also reset your device to see whether the issue was resolved.

Moderators Reject All Decal Images

Images obtained through search engines rarely make it past the moderators. You need to ensure that images uploaded to the platform are customized. If you’ve made the image your own, you may have to wait for the moderators response or contact the Roblox Help Desk for support.

FAQs

How can you locate a Roblox decal ID?

You can quickly find the decal ID by simply checking the decal URL.

What is a decal ID?

These are unique designations associated with each specific decal uploaded on the Roblox platform.

Which Roblox Decal IDs are most popular on the platform?

While the list of decal IDs keeps growing with the continuous introduction of decal images to the platform, 91049678 and 1367427819 are some of the popular decal IDs in Roblox.

Can you create your own Roblox decal?

Yes. You can. However, it will need to go through the platform moderators for approval to uphold Roblox’s Terms of Service and Community guidelines.

Why is my decal image getting scaled down?

Roblox only accepts images up to 1024 x 1024 pixels.

How long does Roblox take to approve your decal?

There isn’t a specific duration for this. The images go through special checks that vary depending on the design. While it may take a couple of minutes for others, it may take even a day for some.

Let Your Creativity Run Wild With Roblox Decals

Roblox’s customizable interface is one of the most fantastic features of the platform. Knowing how to use decals in Roblox can significantly elevate your gaming experience by allowing you to customize different gameplay elements. It also helps to cultivate your creative freedom in a beautiful way. But, keep yourself informed on Roblox’s Terms of Service and ensure you only upload decal images that meet the platform’s rule of engagement. Violating these terms can result in suspension, or in worse scenarios, you may face a permanent ban from your game. Even associated group links to your account can bear the impact of your term violations, so it’s critical that you stick to platform guidelines.

Have you ever explored the Roblox decal library? Would you advise other gamers to utilize decals or pursue other options, such as Textures in Roblox? Let us know in the comments section below.

Disclaimer: Some pages on this site may include an affiliate link. This does not effect our editorial in any way.