One of the most commonly reported issues with Android devices is the dreaded “No SIM card” error message. This problem can be pretty frustrating since you can’t make calls, send texts, or even access the internet when it’s in that state.

You might have tried restarting your phone and looking for clues in your settings menu, but nothing works. The error message can result from several different causes, but unfortunately, no single solution will fix it for everyone.

In this article, you’ll find several processes to troubleshoot your situation to get back up and running quickly.

Recommended Solutions when No SIM Card Detected

Solution 1: Reboot Your Device

The first step to fixing the issue is rebooting your phone. Android systems are designed to attempt repairs and solve software issues whenever your boot up. To restart your phone:

- Press down the “power” button (the “Bixby+Volume” button on some Samsung models) and select “Restart” or “Reboot” from the pop-up menu.

- Confirm your choice on the pop-up screen.

- Give your device time to power back up again.

When you boot up, your phone will attempt to reconnect with your network provider, initiating a new search for your SIM card.

After rebooting, you should also be on the lookout for any messages from your carrier that may have instructions on fixing the issue. It’s not uncommon for providers to experience technical glitches that culminate into network failure.

Solution 2: If Reboot Fails, Shut Down Your Phone

In most cases, rebooting your device solves the problem. However, it doesn’t always do the trick. Some Android users have reported that the “No SIM Card” error message persists, even when they restart their phones. If this happens to you, don’t fret. Shutting your device and waiting at least 30 seconds before powering it back up can be the solution. To shut down your device:

- Press down the “power” or “Bixby+Volume” on some Samsung models and then select “Turn off” or “Power off” from the pop-up menu, depending on the type of device you’re using.

- Confirm your choice on the pop-up screen.

You may also need to unplug your device from any power source. If you want to be even more thorough, remove your battery as soon as you power off your device, then hold the power button to drain any residual power.

When you power off your phone, it terminates all connections with cell towers, and its radios are turned off. When you power back on, your system initiates connection sequences afresh. In the process, any temporary glitches or network errors may be solved.

Solution 3: Adjust the SIM Card

Your phone can only read your SIM card if the SIM card is firmly seated in its slot. If the card is dislodged or misaligned, which can occur after you drop your phone accidentally, you won’t be able to connect to your carrier. Or, if your device is new, you may not have inserted the SIM card correctly. Thus, the next troubleshooting step should be removing the SIM card and inserting it back in.

Pro tip: If you don’t have a SIM popping tool, use an earring or tiny paperclip and apply pressure.

While doing this, ensure the SIM card fits securely into your device. Place a piece of tape, cardboard, or paper into the tray to achieve a tighter fit if it appears loose. Although it may seem like an unconventional fix, adjusting the SIM card in this way works for many Android users.

As a rule of thumb, you should avoid applying too much pressure when handling your phone’s interiors. Excessive force can damage your device’s hardware and create new problems.

Solution 4: Remove, Clean, and Re-Insert Your SIM Card

Adjusting your SIM card won’t solve the “No SIM Card” error if the SIM tray is filled with dirt or grime. For best results, here’s how you should clean your SIM card and SIM card slot:

- Power off your device.

- Find the SIM card tray on the inside of your device.

- Open the SIM card tray and pull out your SIM card. While doing so, be careful not to use excessive force. Also, the SIM card tray may not be accessible on some devices. If you’re not sure how your device’s tray works, check the documentation for your device.

- You’ll want to clean the Sim card slot with a small brush or tissue swab. If you’re unsure what brush to use, find a tiny, soft microfiber cloth. You can use an airbrush cleaner as well if you have one available. After the first round of gentle scrubbing, the cleaner works best to remove any dirt and grime that may still be stuck in the SIM card tray. Also, ensure that nothing insertable (like a toothpick or paperclip) blocks your SIM card assembly area.

- Clean your SIM card using a soft microfiber cloth. You may soak the fabric in rubbing alcohol or some other non-conductive spray. Once all dirt and grime are cleared, dry off any excess liquid before sliding the SIM card back in.

After cleaning and re-inserting your SIM card, you should power your device back on and check whether the problem is solved.

Solution 5: Clear the Cache Data

Although clearing cache data is usually recommended when there’s a malfunctioning app, it can also solve SIM card errors. Sometimes cache data gets corrupted, which can cause many performance problems for your device. Clearing your cached data can fix network crash bugs or force your device to reallocate memory resources, leading to a reconnection to your carrier.

Here’s how to clear cache data on Android devices:

- Open “Settings.”

- Navigate to “Storage.”

- Open “Internal Storage.”

- Tap on “Cached Data.”

- Confirm that you want to clear cached data in the dialog box that appears.

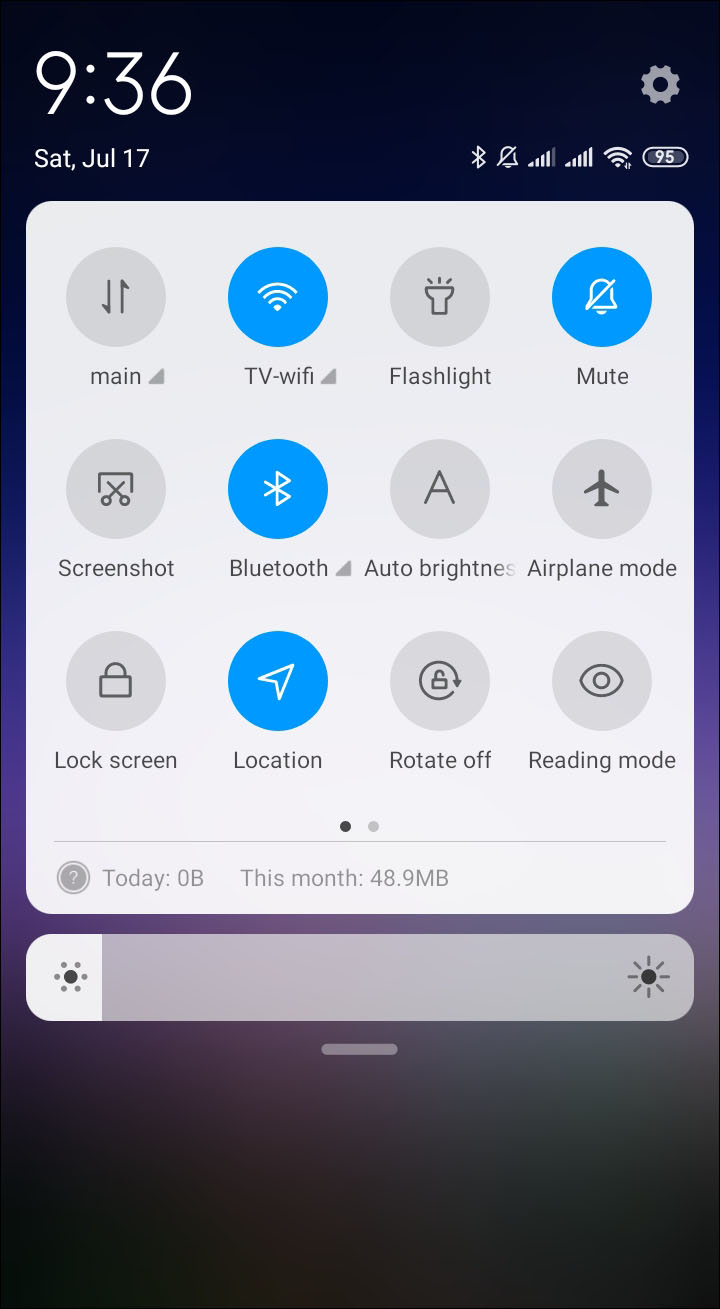

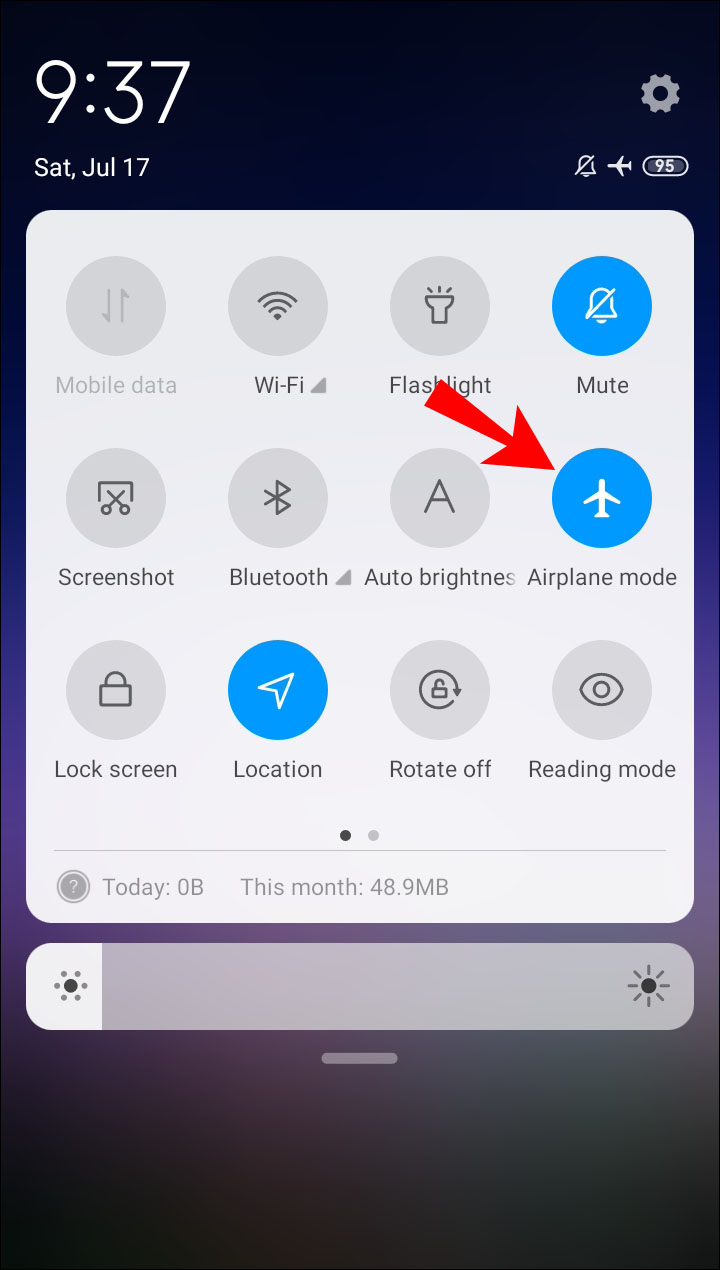

Solution 6: Switch on Airplane Mode

There’s always a chance that the “No SIM Card” error message has nothing to do with your SIM card. You should try inserting it into a different phone to determine if the SIM card works. If it receives signals in the new phone, your signal problem could be miscommunication between the nearby cell towers and your original device. In this situation, Airplane mode can be the solution.

When you activate Airplane mode, you turn off all wireless radios on your device, including cellular radio, Wi-Fi, and Bluetooth. Communication with cell towers is cut off immediately. Your device is forced to re-establish a connection when you leave Airplane mode.

To activate Airplane mode on your device,

- Swipe down (or up) to open the notification screen.

- Tap on “Airplane mode” or “Flight Mode.”

- Confirm that you want to activate Airplane mode in the dialog box that appears.

- After a minute or two, exit Airplane mode and check whether your SIM card is now readable.

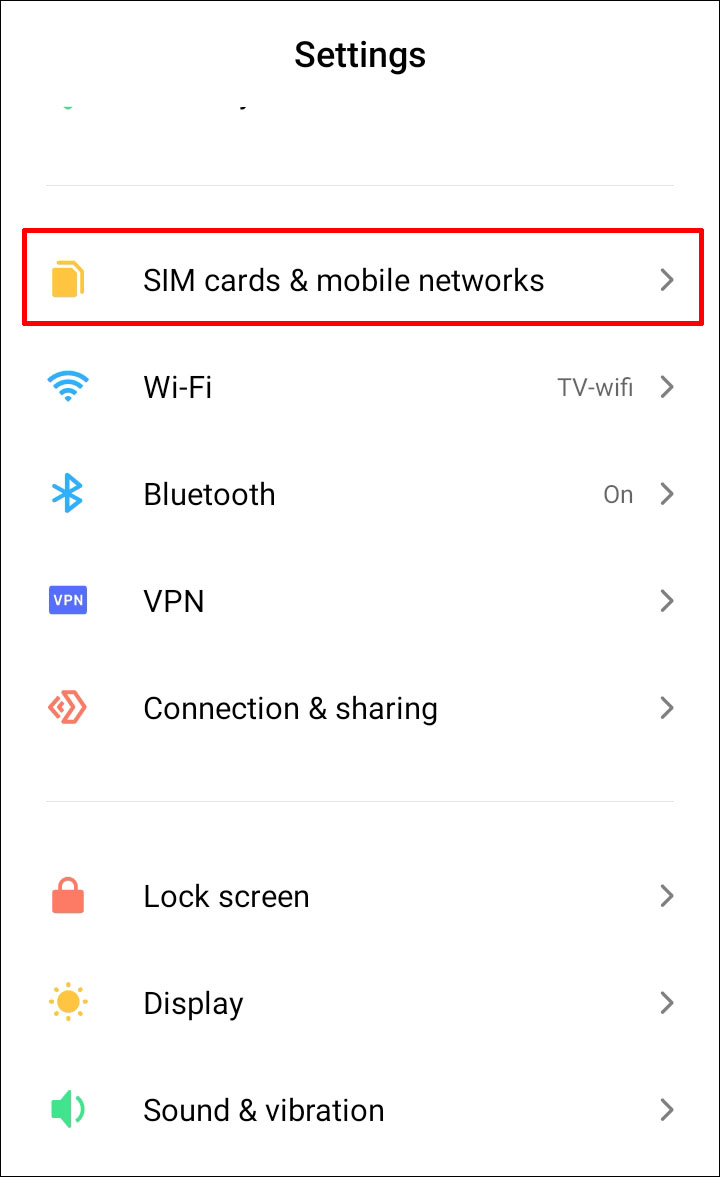

Solution 7: Choose Network Operator

An undetectable SIM card can be extremely frustrating. You could miss business meetings and appointments or fall behind on emerging issues for hours. Before getting a new SIM card, you should manually choose your network.

If your device is set to a different network operator than your chosen one, the “No SIM Card” error is inevitable. Here’s how to make sure you have the correct network settings:

- Open “Settings.”

- Navigate to “Mobile Networks.”

- Tap “Search Networks.” Your device will take a few moments to search all available networks and display the results.

- Tap your current carrier to set it as the preferred network.

Solution 8: Check for Physical Damage

If your phone has moisture damage or the frame is bent, the motherboard may likely no longer read the SIM card.

First, lay your phone on a flat surface (screen side down). If it wobbles, the frame may be bent. You can try the remaining solutions in that case, but the hardware may affect the SIM card’s functionality.

Next, has your phone been exposed to moisture or liquid? Even if the liquid damage occurred ages ago, corrosion could occur over time, resulting in the “No SIM Card” error.

Lastly, check the SIM tray. Does it slide in easily? If you feel resistance, use a flashlight to ensure the SIM slot isn’t damaged and there isn’t any debris inside.

Solution 9: Replace Your SIM Card

If you’re getting the “No SIM Card” error, physical damage to your SIM card could be the culprit. You should get a new SIM card from your preferred carrier. You can still keep your phone number but may lose your data. You might want to back up any important files first.

Solution 10: Reset the Device to Factory Settings

If none of the above solutions worked, consider resetting your device to the factory settings. However, resetting your phone will erase all the data accumulated over time and lose any customized settings. Thus, you should back up your data before initiating the reset.

Sim Card Not Working FAQs

Why can’t my phone detect my sim card properly?

This can happen for several reasons:

1. There could be connection problems between your device and the cell towers of your preferred carrier. To determine if this is the case, activate Airplane mode, restart your device, clear the cache data, or shut down your devices for a few minutes.

2. Your SIM card could be dislodged from its position. To solve the problem, switch off your device, pull out the SIM card, and then slide it back in.

3. Your SIM card tray could be clogged with dirt and grime. Try cleaning it with a soft microfiber cloth or rubbing alcohol.

4. There’s a possibility that your device is not set to the correct network operator. You should make sure that you’ve selected the right operator in Settings.

5. It could be due to physical damage to your SIM card. A new chip from your carrier should solve the problem.

Keep Signal Problems at Bay

For several reasons, your phone may display the “No SIM Card” message. In this article, we’ve outlined some troubleshooting steps to help you get back on track. You should never have to miss a call or video chat due to signal problems.

Have you had signal problems on your Android device? Let us know in the comments section below.

Disclaimer: Some pages on this site may include an affiliate link. This does not effect our editorial in any way.