There are plenty of reasons you might want to duplicate your phone display on your TV. Whether you want to browse pictures, play games at a high resolution, or even watch movies or your favorite TV show, most smartphones can help you do so.

But an iPhone is a different beast. When trying to pair your iPhone with your Chromecast dongle, there are definitely some things that you need to know about.

Is There Native Support?

Unfortunately, there is no native support on iPhones to mirror your screen with a Chromecast device. That said, the community is always eager to solve these sorts of problems on its own. As a result, there are a few ways around this issue involving third-party apps.

Our First Choice – Replica App

You can download Replica on the App Store. You also need to make sure that your Chromecast is configured through the Google Home app. Here are the steps you need to follow for a quick and simple mirroring process:

- Connect both of your devices to the same Wi-Fi network.

- Launch Replica from your phone.

- Find your Chromecast device from the list of devices displayed, then tap on the desired device to connect to Chromecast.

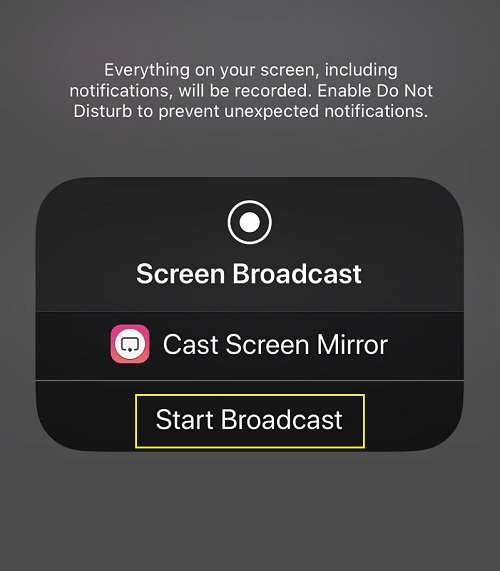

- Tap on the Start Broadcast option.

Are there issues? As with any third-party app, you can expect some inconsistency in performance. Older iPhones might have a more difficult time handling the screen mirroring process. It’s also possible that if you do not properly configure your Chromecast, by following the on-screen prompts and ID-ing the device, the Replica app won’t display it on the list of available devices.

The advantage? Replica is a free-to-use app, so it won’t hurt to give it a shot, regardless of your OS version. Every good app will give you some upsells. If you want Replica to work even better or experience additional features, you will have to go for one of the subscriptions.

Alternative – Screen Mirror for Chrome Cast

Another app you can use is the Screen Mirror for the Chromecast app. It has been developed by iStreamer, and you can find it under the Utility category on the App store.

This app is compatible with iPhones, iPads, and even iPod Touch. However, it will only run on iOS 11 or newer. While it may not have multi-language support, the interface is straightforward, so it’s easy to use.

The app is also free to use but only for two months. It has some subscriptions available, so keep that in mind if you find its functionality somewhat limited or even clunky at times.

Once you download and install the app, start your free trial, and follow the on-screen instructions. These are as basic as they can be since they only involve selecting the device you want to duplicate your screen on.

Just note that the app won’t also handle the audio transfer. The same goes for the previous recommendation, the Replica app.

iWebTV: Cast Web Videos to TV

Available for free on the App Store, iWebTV is another application with great reviews for streaming content from an iPhone to your Chromecast.

iWebTV is a simple application that allows you to mirror your iPhone to other devices. Simply download the app and tap the screen mirror icon in the upper left-hand corner. Assuming you’re on the same Wi-Fi network as your Chromecast, any Firesticks or smart TVs will appear in the menu.

You will need to download the iWebTV app to your other devices in order to create a seamless stream of content. Simply visit the Chromecast app store and begin the download for iWebTV. Once connected, you can stream the content you love from your iPhone or iPad.

What You Need to Know About Mirroring Apps

For the most part, screen mirroring apps will do their job. But you may run into things like DRM limitations. This means that not all apps that you have open on your screen can be captured.

While most apps claim to support HD casting, not all of them can promise a low delay. And finally, not every mirroring app will also help you get your phone audio out of the TV speakers. You should expect to have to perform some additional configuration steps in some situations.

Mirror to Your Computer

You can avoid downloading third-party apps by using your computer to mirror the content of your phone to your Chromecast. Using the phone’s built-in screen mirroring option, you can send content to your PC or Mac. Once the two devices are connected on the same Wi-Fi network, set your Chromecast up as you normally would and begin streaming.

To connect your computer to your Chromecast, try this:

- Verify that bother your PC or Mac is on the same Wi-Fi network as your Chromecast.

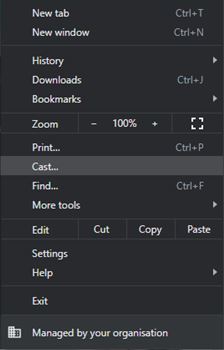

- Using the Chrome browser, click on the menu option in the upper right-hand corner.

- Click the option for Cast.

- Select the option to mirror your screen.

You can choose to cast your entire screen or just the Chrome browser. For our purposes, it’s best to cast your entire screen because you’ll be mirroring your iPhone.

Is It Worth Using a Mirroring App?

Well, if you’re an iPhone user and you want to use your Chromecast TV as your phone display, there’s no other way around it. Since Apple clearly isn’t making any progress in this direction, you’ll have to either use limited functionality free apps or pay for the full-service experience. The good news is that there are at least three apps available that are very convenient to use and cast high-quality videos.

Hopefully, Apple’s version of Google Chrome will allow you to cast your content one day. As it doesn’t at the time of writing this article, we will have to wait for updates to make a more seamless viewing experience for those who love Apple mobile devices and their Chromecast for entertainment.

Frequently Asked Questions

Can I AirPlay to Chromecast?

AirPlay is Apple’s native casting function. Unfortunately, it isn’t compatible with Chromecast devices. You will need to use one of the third-party applications we’ve mentioned above to stream content from your Apple device to your Chromecast.

Can I cast from the Chrome Browser on my iPhone?

Unfortunately, no. The option won’t appear when you try to cast content from your iPhone’s Chrome Browser.

Disclaimer: Some pages on this site may include an affiliate link. This does not effect our editorial in any way.