There are few scenarios more annoying than when your sound isn’t working while browsing the internet. You’ve probably experienced this at some point or another, and you’re not alone; it’s a very common issue. Fortunately, it’s nothing serious most of the time, and solving this problem merely requires following a few straightforward steps.

In this article, we’ll provide detailed instructions on troubleshooting issues of sound not working in Chrome for Chromebook, Mac, Windows, and Ubuntu users.

How to Fix Sound Not Working in Chrome?

As we already mentioned, the sound not working while watching a video on Chrome is a relatively common issue that can happen for various reasons. The problem can be as simple as accidentally muting speakers or a more serious one, such as hardware damage.

No matter what operating system your computer runs, we’ll start with the steps to try directly related to the browser. If these don’t work, proceed with the steps we provided further down for each OS.

- Launch Chrome.

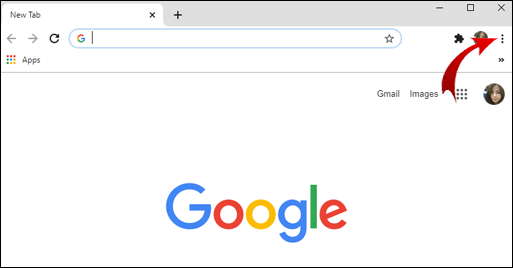

- Click on the three dots (or three horizontal lines) in the upper right-hand corner of the browser.

- Go to the Settings page.

- Scroll down and click on Advanced to show the advanced options.

- Now, under the Privacy and security tab, click on Site settings.

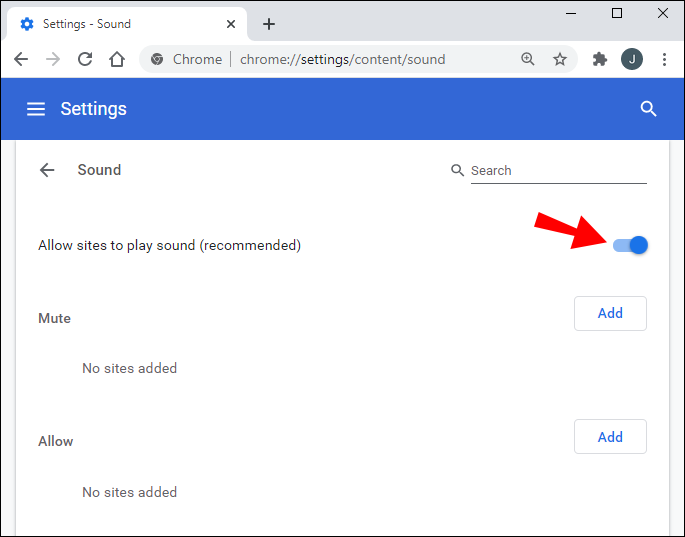

- Scroll down to Sound and click on it.

- The toggle button on this page should be On, and you should see Allow sites to play sound (recommended). If you see Mute sites that play sound, toggle the button next to it.

Try visiting the web browser again to see if your sound works properly.

Further Sound Troubleshooting the Chrome Browser

If the solution above didn’t solve your sound issues, there are more options that might. Try these fixes to get your sound working:

- Play sound in another browser; this will help determine the origin of the problem.

- Refresh the current Chrome tab not playing sound.

- Restart Chrome.

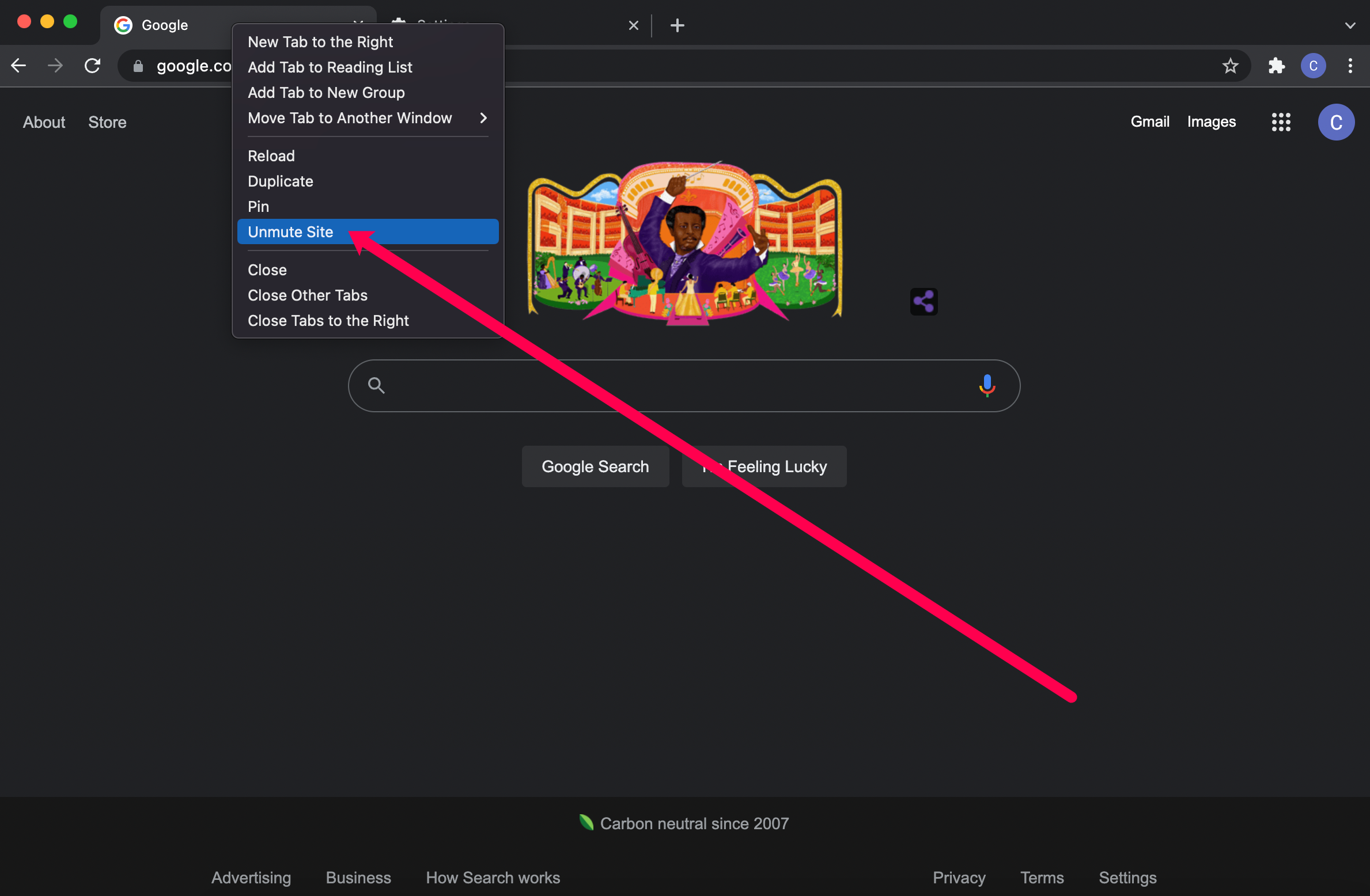

- Make sure the page is not muted by right-clicking on its tab. If muted, you’ll see an Unmute site option.

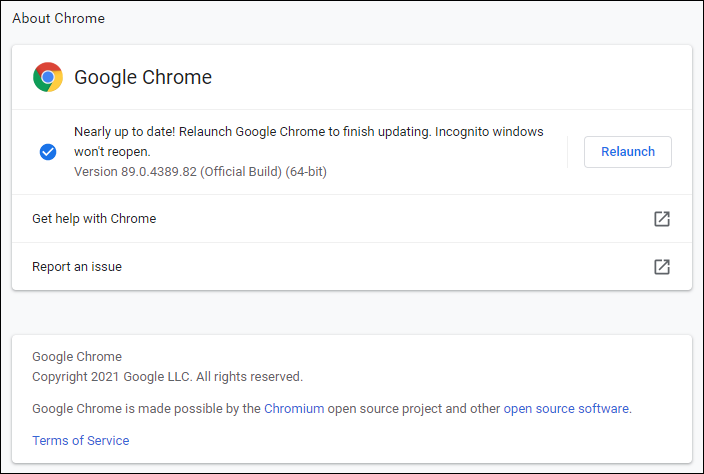

- Make sure the latest version of Chrome is running. If there’s an update available, the Update Chrome message will appear when clicking on the three vertical dots in the top right-hand corner of the screen.

- Clear cookies and the cache in Chrome by clicking on the three dots at the top right-hand corner, then More tools > Clear browsing data, and then All time > Clear data.

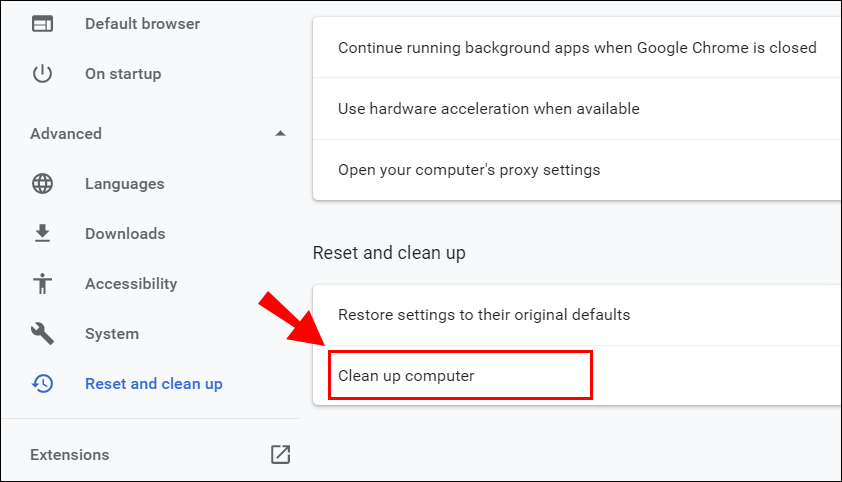

- Check for potential malware. Open Settings in Chrome, go to Advanced, Clean up computer, then Find. If there’s malware found, select Remove.

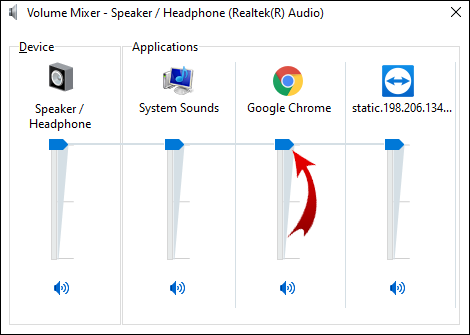

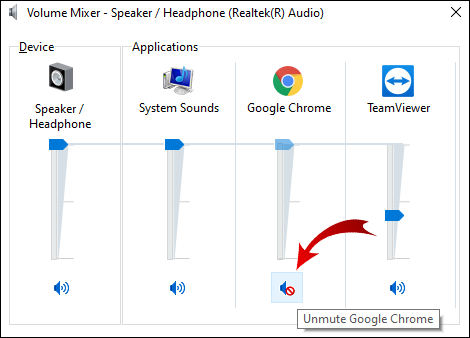

- Make sure that Chrome isn’t muted and its volume isn’t turned too low in the Volume Mixer.

- Go to chrome://extensions and disable the Pepper Flash extension if it’s there.

- Delete and reinstall all other extensions and check for sound after going over each one.

- Inside Chrome, go to Settings > Advanced > Reset; this will reset your Chrome settings.

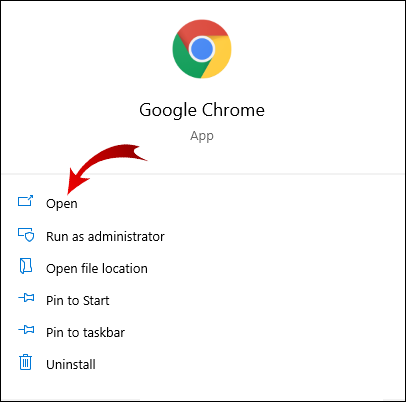

- Re-install Chrome by completely removing it from the PC (via Control Panel, then Uninstall a program) and installing it again. Or, from a Mac (Go to Finder and drag Chrome to the trash can).

Of course, you should also check your audio hardware and Bluetooth settings as well. If other browsers have sound with the same website, then it isn’t the website or your computer hardware.

How to Fix Sound Not Working on Chromebook?

If the general steps for fixing the “sound not working” issue didn’t help, here are some of the most common fixes for Chromebook users:

- Check to make sure the headphones are correctly plugged in. On many devices, there should be an audible click when pushing them inside your device.

- Ensure the Allow sites to play sound (recommended) option is enabled in the Chrome sound settings (chrome://settings/content/sound.)

- Make sure the page is not muted by right-clicking on its tab. If it’s muted, you’ll see an Unmute site option.

- If there’s a cross mark through the speaker icon in the address bar of the tab, click on it and then click on Always allow sound on [website] and click Done.

- Open another browser and test the sound; this will show whether the problem is in Chrome or beyond.

- Check if some malware is blocking the sound by going to Settings > Advanced > Clean up computer, then Find. If there’s unwanted software, select Remove.

- Use the latest Chrome version.

- Check your Chromebook’s sound settings. Click on your profile picture in the lower right-hand corner of the screen to open the Chromebook information window. Here is where to check whether the audio is muted. Also, see if the destination output matches the output you’re currently using.

- Clear Chrome and Chromebook cache.

- Reset or disable all Chrome extensions.

- Restart Chrome.

- Restart the computer.

How to Fix Sound Not Working in Chrome on Mac?

Here’s a common fix for the sound not working on Mac:

- Open System Preferences.

- Next, click on Sound.

- Select the Output tab and navigate to Built-in speakers.

- Check whether the volume slider is set to low. If so, move it to the right.

- Make sure to deselect the Mute checkbox if it’s checked.

If this solution didn’t work, try the following ones:

- Relaunch the Chrome tab not playing sound.

- If there’s a cross mark on the speaker icon in that tab’s address bar, click on it. Then, click on Always allow sound on [website] and click Done.

- Try playing sound in another browser; this will help determine whether the problem is with Chrome or something else.

- Make sure the page is not muted by right-clicking on its tab. If muted, there will be an Unmute Site option.

- Make sure you’re running the latest version of Chrome by going to Settings > About Chrome; Chrome will automatically update to the latest version available (if it’s not already installed).

- Disable all Chrome extensions, starting with Pepper Flash if you use it.

- Remove any malware that might be blocking the sound by going to Settings > Advanced > Clean up computer, then Find. If there’s malware found, select Remove.

- Clear Chrome cookies and cache.

- In Chrome, go to Settings > Advanced > Reset to reset Chrome settings.

- Reinstall Chrome.

How to Fix Sound Not Working in Chrome on Windows 10?

If the sound not working issue in Chrome is happening on a computer running Windows 10, and the solutions mentioned above didn’t work, try the following:

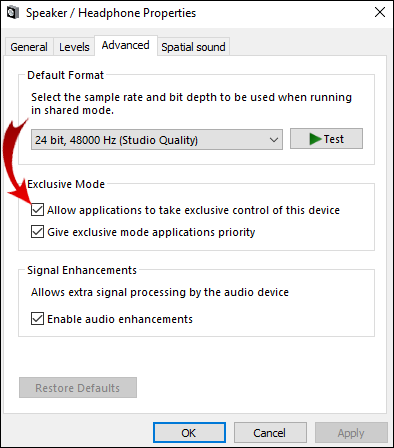

- Run the Control Panel and navigate to Sound, then Speakers.

- Now, go to the Advanced tab and uncheck (or check) the box next to Allow applications to take exclusive control of this device.

- Play sound in Chrome and launch the Volume Mixer. To launch Volume Mixer, right-click on the speaker icon in the bottom right-hand corner of the screen.

- Unmute Chrome.

How to Fix Sound Not Working in Chrome on Ubuntu?

If you can’t hear sound in Chrome on Ubuntu, first make sure the sound is not completely muted from your computer. Check for this in the system menu. If the overall sound is not muted, check whether a specific app (Chrome) is muted:

- Launch the Activities overview, type Sound, and click on it.

- This will open the sound panel. Navigate to Volume Levels and see if Chrome is muted.

If this doesn’t help, proceed with the following solutions, making sure to test the audio after each one:

- Play the sound in another browser to make sure the problem is in Chrome.

- Re-open the tab that’s not playing sound.

- Relaunch Chrome on your computer.

- Make sure the mute switch on the keyboard is not on. If so, press it to unmute the sound.

- Clear cookies and the cache in Chrome. Click on the three dots at the top right-hand corner, then More tools, then Clear browsing data, then All time, then Clear data.

- Check for potential malware. Open Settings in Chrome, go to Advanced, Clean up computer, then Find. If there’s malware found, select Remove.

- Go to chrome://extensions and disable the Pepper Flash extension if it’s there. Disable other extensions one by one as well.

- Go to Chrome’s Settings, Advanced, then Reset to reset the Chrome settings.

- Re-install Chrome.

- On the computer, go to Activities > Sound > Output, and then change the Profile Settings for your audio device.

How to Fix Sound Not Playing on Chromecast?

If the sound is not playing when casting to Chromecast from your browser, try these solutions:

- Select the cast icon inside the Chrome browser and make sure audio is enabled.

- Unplug the Chromecast device from the HDMI port for a few seconds while keeping the USB cable plugged in.

- Turn the TV off and then back on.

- Reinstall Chrome on your computer.

- Disable the CEC (the option that permits the TV to be controlled by a single remote) on the TV and reboot it afterward.

Additional FAQs

Here are more questions to help understand and fix issues of the sound not working in Chrome.

Why Is Sound Not Coming in Chrome?

There are a few reasons why sound might not be coming in Chrome. The problem can be as simple as PC sound being muted or more complicated such as serious hardware issues. If sound is coming from other browsers (Edge, Safari, etc.), then the problem stems from Chrome.

How Do I Unmute Google Chrome?

If there’s no sound coming from a specific Chrome tab, chances are the issue is quite simple, like the tab being muted. Fortunately, unmuting a Chrome tab is a breeze. Apply these two straightforward steps:

1. Right-click on the tab you want to unmute.

2. Click on the Unmute site option from the drop menu.

The chrome tab should now be unmuted.

How to Fix Chrome Not Responding?

Various problems can cause Google Chrome to stop responding. Depending on the cause, the solutions may vary. Here are some things to check or do to help fix this problem:

1. Use the latest Chrome version. Head over to Google Chrome Settings > Help, then About Chrome. If there’s a newer version, Chrome will search for it and automatically update.

2. Restart Chrome.

3. Reset Chrome Settings to default or reinstall the app.

4. Clear the Chrome Cache or History.

5. Disable extensions. If there’s a recently added extension, start by disabling it first.

6. If none of that worked, try restarting your computer.

Why Is There No Sound on My Live Stream?

If there’s no sound on your live stream, try applying these steps:

1. Make sure your OS volume mixer isn’t muting the browser or platform being used for the live stream.

2. Go to the broadcaster’s settings and choose the correct devices there. Alternatively, add a proper device as a source.

3. Check under the broadcaster’s additional audio settings. Enable a proper audio device for the channel being sent to the stream.

4. Try streaming to another service.

Fixing Chrome Sound Issues

It’s never a pleasant experience not having access to sound in Chrome or any other app for that matter. Fortunately, this issue is relatively easy to solve. That’s why we’ve provided detailed steps to fix or work around the sound issues for different operating systems.

On a final note: always go with the most straightforward solution first and gradually move to the other ones. If every available solution has been tried and the problem persists, consider contacting a computer technical service since you might be experiencing hardware issues.

Which solution worked the best regarding the sound not working issue in Chrome? Are there any other ways that can help with this issue? Share your experiences in the comments section below.

Disclaimer: Some pages on this site may include an affiliate link. This does not effect our editorial in any way.