Device Links

Many people like the convenience of the OneDrive cloud storage platform. Every Office 365 subscription comes with OneDrive and some free space, and it doesn’t hurt to back up files to the cloud. However, some users have multiple accounts.

OneDrive comes in personal and business versions, and they’re usually separate. Even so, there are ways to add a second account to your OneDrive client. Read to the end and become a OneDrive expert.

How to Add an Account to OneDrive

Adding an account to OneDrive is possible, but there are some restrictions that you should know.

Can You Add Accounts to OneDrive?

Yes, you can add more accounts to OneDrive, but there’s a catch. Only one personal OneDrive account can be on your PC at any time. However, there’s no limit to how many school or business accounts can be on your computer.

In short, you’ll need a non-personal OneDrive account so that your computer lets you add it. To access another OneDrive personal account, you must log out of the current one.

Of course, this refers to the OneDrive desktop client, which directly integrates with Windows 10 PCs. You don’t even have to install it.

If you try to add two personal accounts, you get an error message instead. The message tells you to unlink it before adding the second one.

Add Accounts to OneDrive on Windows

To add OneDrive accounts to your computer, you don’t need to perform any special steps. Simply launch the client and start from there.

- Open the OneDrive app on your PC.

- Sign in to your personal account if required.

- Click on “Open My OneDrive Folder.”

- Navigate to the taskbar and look for the OneDrive icon on the bottom-right corner.

- Right-click the icon.

- Select “Settings.”

- Go to the “Account” tab and select “Add An Account.”

- OneDrive Setup will start, and you can log in to your school or business account.

- Sign in.

- You can now access both OneDrive folders through Windows File Explorer.

You may repeat step six to add a third or even fourth account. You’re good to go as long as it’s not a personal account.

Sometimes, OneDrive might not appear on the taskbar. In this situation, the icon is likely collapsed into a panel. Click on the arrow to reveal it.

This phenomenon happens when you have too many running background apps. Windows will hide them so it doesn’t overcrowd the taskbar. Fortunately, if you already installed OneDrive, it’s always running unless you quit the app.

Add Accounts to OneDrive on Mac

Some OneDrive users are on a Mac, and there’s a macOS client designed for them. The account limitations are identical to Windows users, meaning only one personal OneDrive account is allowed.

- Launch OneDrive and sign in if prompted.

- Go to “Help And Settings.”

- Select “Preferences.”

- Click on the “Account” tab.

- Pick “Add An Account.”

- Wait for OneDrive Setup to launch.

- Sign in to your second account.

With a similar process, even Windows users can adapt quickly. The options may have different labels, but there’s almost no difference.

Add Accounts to OneDrive on a Mobile Device

OneDrive is also on iOS and Android as an app. You can download it for free and access your files on the go.

The mobile apps allow users to add work or educational accounts, just like on computers. The steps are as follows.

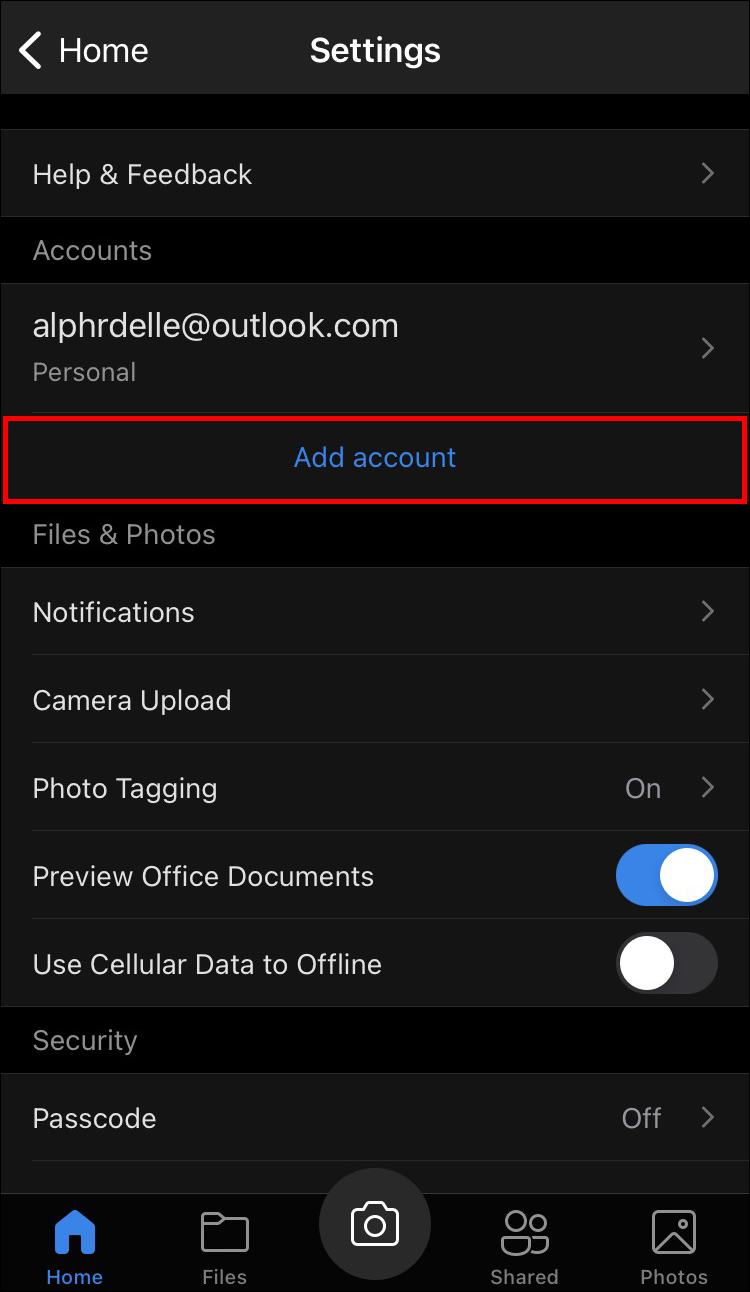

- Launch the OneDrive app on your mobile device.

- Tap on your profile picture.

- Go to the Settings menu.

- Look for “Add Account.”

- Sign in to your second OneDrive account.

Alternatively, you can already tap on the “Add Account” button and icon beside your existing accounts’ profile pictures.

Issues From Having Multiple OneDrive Accounts

Multiple OneDrive accounts will easily expand your storage capacities, but there are times when one doesn’t sync with another. This issue can arise if one device’s OneDrive client isn’t up-to-date. Therefore, keeping OneDrive updated on all your platforms is crucial.

Fixing the problem isn’t tricky, but it does take time, and you might not have the luxury of waiting.

Some third-party apps like Shift and MultCloud let users manage multiple cloud accounts in one app. You can even combine OneDrive with Google Drive.

Additional FAQs

How many OneDrive accounts can I have?

You can have one personal OneDrive account but as many work or educational accounts as you want. If you have access to one of each, that makes three you can use at any time if you add them to the same device.

Can I have two OneDrive accounts on an iPad?

Yes, you can follow the steps we outlined above for mobile devices. OneDrive is available for iPad the same way it can be downloaded on other mobile devices. The account limitations are no different.

Will deleting something from OneDrive delete the same object on a phone?

If the devices are synced, deleting something on a PC will do the same on a mobile device. Removing something on your phone will also have an identical result.

Almost Like One Drive

OneDrive’s personal account limit of one doesn’t prevent users from adding other accounts from school or work. The process only takes several minutes and will let you access everything in one place, saving you valuable time in the long run.

How many OneDrive accounts do you have? How long have you used OneDrive? Let us know in the comments section below.

Disclaimer: Some pages on this site may include an affiliate link. This does not effect our editorial in any way.